CDFI Lending & Race: A New Method for Assessing Impact

Many CDFIs that exist to serve historically underserved communities of color are caught in a bind following the 2023 U.S. Supreme Court ruling against Affirmative Action (Students for Fair Admissions v. Harvard, 600 U.S. 181 (2023)).

At least one CDFI has been sued by a conservative legal organization in what appears to be a test case of extending the Supreme Court’s ruling to CDFIs. Many CDFIs wonder whether they might be next.

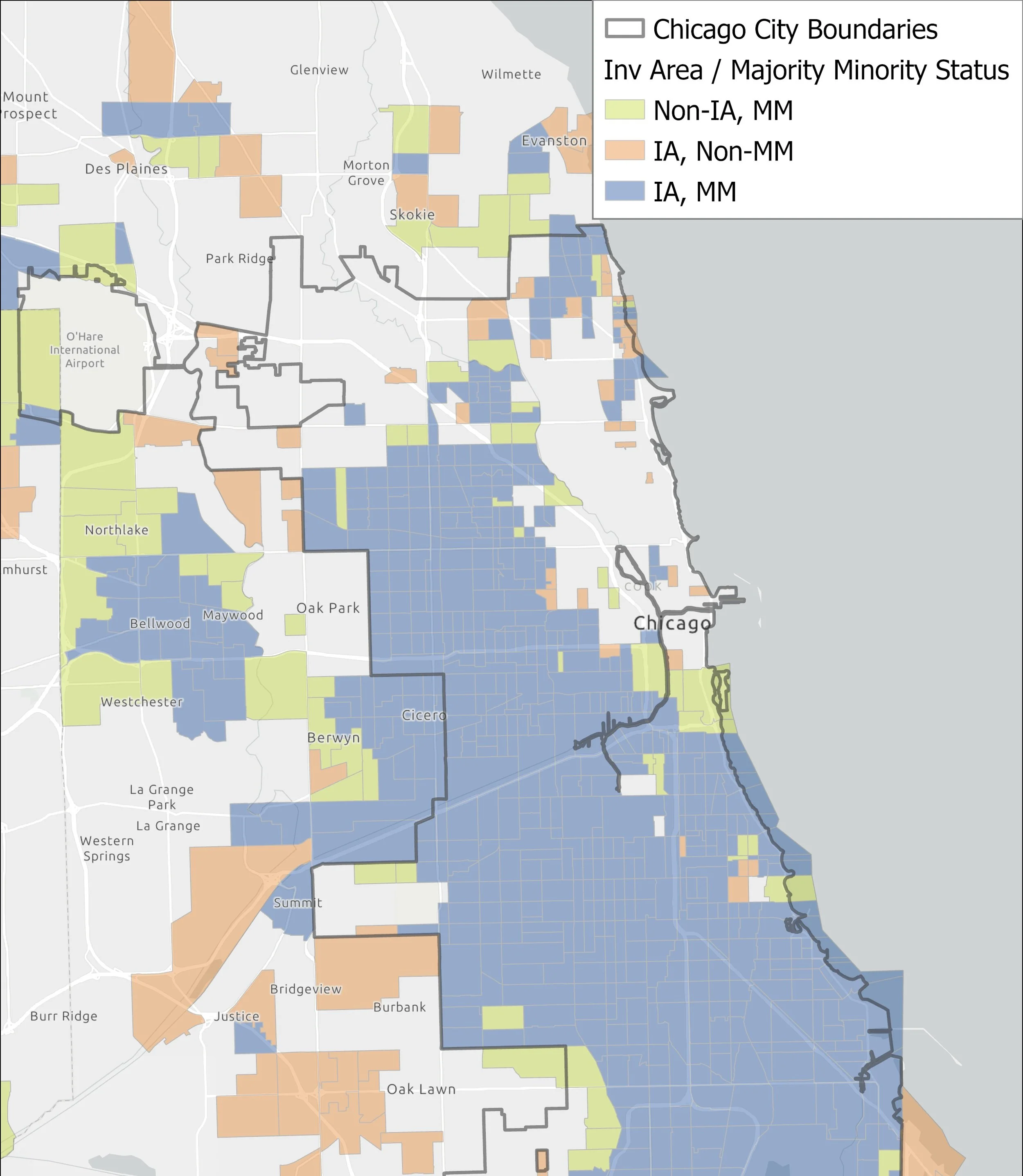

Using our new CDFI Market Map, CDFI Friendly America completed a unique and unprecedented analysis of “Place, Race & CDFI Lending” using CDFI Fund Qualified Investment Areas (IAs) and Transaction Level Report (TLR) data. In our paper detailing our methodology and findings, we report a strong and consistent correlation between race and IAs in urbanized areas, as well as confirmation that CDFI financing effectively targets minority-majority places by concentrating on IAs.

Lance Loethen, of Tract Advisors and consultant to CDFI Friendly America, and I (Mark Pinsky, President of CDFI Friendly America) authored the paper.

“This analysis–which we believe is the first to use IAs as the basis for analysis in this way–found that majority-minority census tracts are much more likely to be IAs than other census tracts,” we concluded, “and that IAs are, as a result, disproportionally more likely to be majority-minority.”

“Therefore, CDFI lending—regardless of CDFIs’ stated goals—is more likely to benefit BIPOC people and communities than other people and places.”

Our research methodology offers a new and unique way of developing, implementing, and evaluating the racial impact of CDFI financing. It is also helpful in understanding long-standing CDFI assumptions and strategies.

We believe our approach should be explored and expanded by others. We suggest two areas for further research:

Comparing places where CDFIs have provided capital to “CDFI Deserts”—places where CDFIs have done little or no financing, and

Analyzing individual CDFIs’ lending in the context of economic distress, race and other factors of discrimination, and lending trends involving both CDFIs and conventional financial institutions.

We believe that banks subject to the Community Reinvestment Act (CRA) and bank regulators enforcing CRA also might benefit by adopting and adapting our approach. CDFI Fund IAs provide a significant, census tract-level basis for evaluating the efficacy of lending for both economic development and racial purposes, especially in urbanized areas.

Mark Pinsky

President, CDFI Friendly America